Published: June 6, 2023

By: Lisa Quilici, Senior Vice President

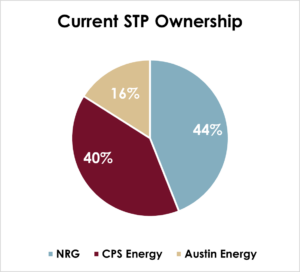

On June 1, 2023, NRG Energy and Constellation Energy announced they had entered into a definitive agreement for Constellation to purchase NRG’s equity stake in the South Texas Project Electric Generating Station (STP), highlighting the importance of nuclear generation in the transition to clean energy and a resurgence in an industry that has seen few transactions since the early 2000s.

- NRG and Constellation announced a transaction value of $1.75 billion for NRG’s 44% interest in the two-unit 2,645 MW station.

- The transaction is expected to close this year, subject to regulatory approvals by the U.S. Nuclear Regulatory Commission, Hart-Scott-Rodino, and, if determined necessary, the Public Utility Commission of Texas.

- The plant, which has renewed operating licenses which expire in 2047/2048, will continue to be operated by the STP Nuclear Operating Company.

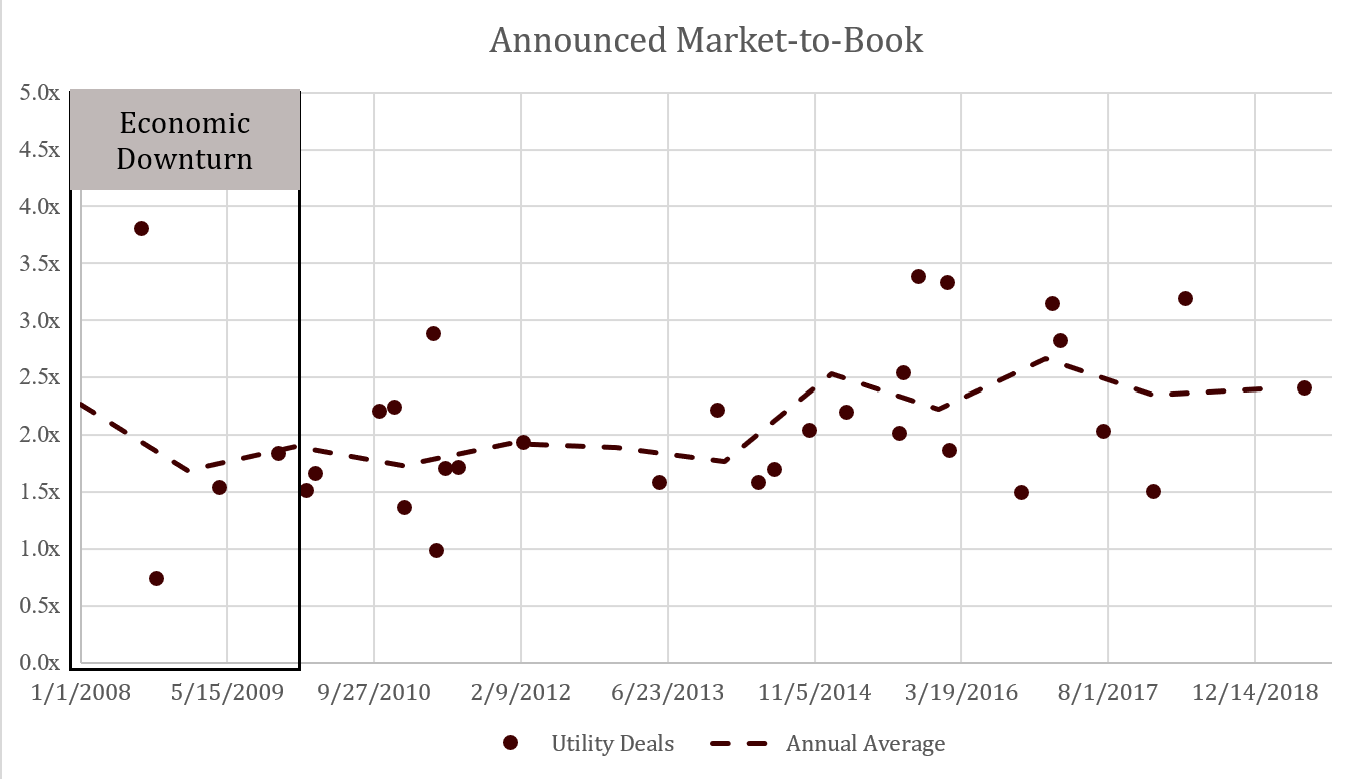

- The STP transfer is the second transaction for an operating nuclear power plant since 2006.1

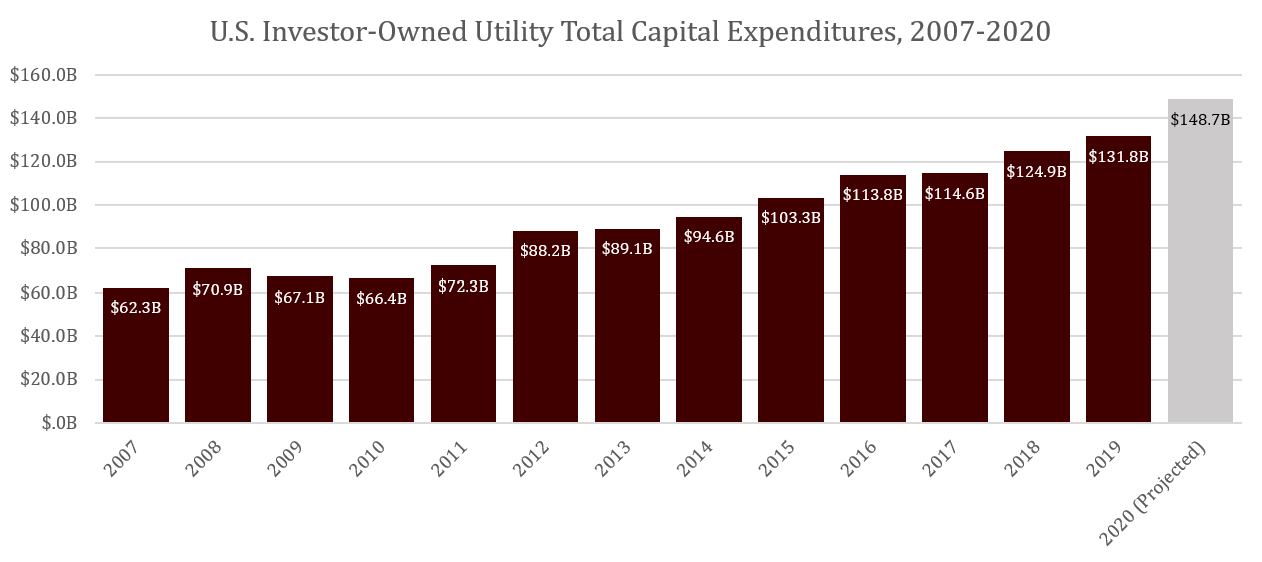

Clean energy transition

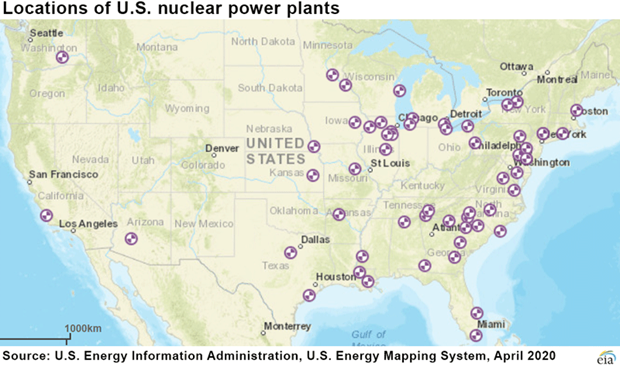

Constellation, both the largest nuclear plant operator and—since its separation from Exelon Corp. in 2022—the largest clean energy company in the U.S., identifies nuclear power as an essential part of carbon-free solutions for the clean energy transition.

Constellation is not alone.

The Intergovernmental Panel on Climate Change highlighted the important role of nuclear energy, wind, solar, and energy storage in reducing greenhouse gas emissions. The Nuclear Energy Institute notes the significant role of nuclear energy in meeting carbon-reduction goals, along with energy security and independence. The National Conference of State Legislatures refers to nuclear power as “the backbone of carbon-free electricity in the United States” and reports a significant increase in state legislation supportive of nuclear power. The Biden administration refers to nuclear power as “the nation’s largest source of clean electricity.”

—

All views expressed by the author are solely the author’s current views and do not reflect the views of Concentric Energy Advisors, Inc., its affiliates, subsidiaries, related companies or clients. The author’s views are based upon information the author considers reliable at the time of publication. However, neither Concentric Energy Advisors, Inc., nor its affiliates, subsidiaries, and related companies warrant the information’s completeness or accuracy, and it should not be relied upon as such.

1 Prior to Constellation Energy’s separation from its former parent, Exelon, Exelon purchased EDF’s 49.99% interest in Constellation Nuclear Group, LLC (CENG) which owned and operated three nuclear power plants—Ginna, Nine Mile Point and Calvert Cliffs. This transaction was pursuant to a 2014 put agreement which granted EDF the right to sell its interest to its former joint venture partner at fair market value. EDF completes sale of its interest in CENG.