Published on July 23, 2020

By: Josh Nowak, Assistant Vice President

The Federal Energy Regulatory Commission (FERC) recently issued an Opinion which represents its latest iteration in its evolving methodology to determine just and reasonable returns on equity (ROE). Opinion No. 569-A, issued on May 21, 2020, was a response to requests for rehearing on Opinion No. 569 in the Midcontinent Independent System Operator (MISO) proceeding. In this decision, several changes were made to the methodology previously adopted in Opinion No. 569.

The methodology established in Opinion No. 569-A relies on an equal weighting of the Discounted Cash Flow (DCF) model, Capital Asset Pricing Model (CAPM), and Risk Premium model, with a detailed account of the source and calculation of each model input. Further, the calculation of both the range of presumptively just and reasonable ROEs, and the just and reasonable ROE determined in this case, relies on a rigid proxy group selection and averaging convention.

What FERC has not addressed, however, is whether this specific methodology would be appropriate in other circumstances. FERC has remained silent on the applicability of the methodology to other ongoing proceedings (e.g., the New England Transmission Owners [NETO] and Potomac-Appalachian Transmission Highline, LLC [PATH] proceedings), or how it will address the comments in its Notice of Inquiry (NOI) Regarding the Commission’s Policy for Determining Return on Equity. Another question is the applicability of the methodology in recently filed complaints and future proceedings. This question is particularly striking given the level of market uncertainty at the time Opinion No. 569-A was issued.

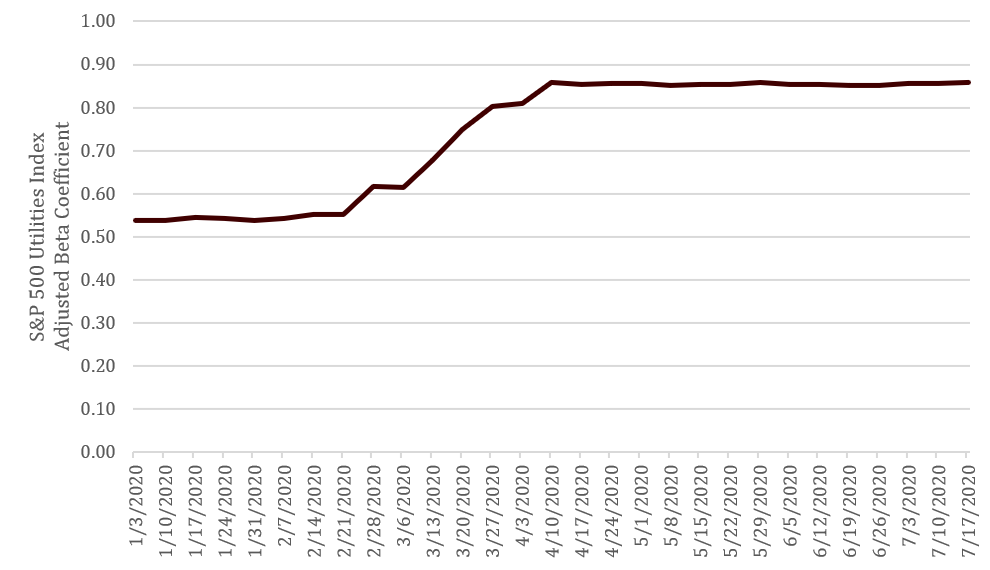

The recent uncertainty related to the economic consequences of coronavirus disease 2019 (COVID-19) suggests a higher level of risk in the marketplace as volatility has reached levels not seen since the Great Recession of 2008/09. In fact, the average of the Chicago Board Options Exchange Volatility Index (VIX) for the 6-month period ending May 31, 2020 was 31.32,[1] which is in the 95th percentile of six-month observation periods since the inception of the VIX. While utilities are sometimes viewed as a safe haven for investors, estimates of Beta coefficients suggest utilities are viewed by investors as riskier in recent months, and utilities’ level of risk has shifted more in line with the broader market. As shown below, estimates of Beta coefficients for the utility industry (as measured by the S&P 500 Utilities Sector), shifted from approximately 0.55 in early 2020 to approximately 0.85 in the period following the market turmoil associated with COVID-19.

Figure 1: S&P 500 Utilities Index – Estimates of the Adjusted Beta Coefficient in 2020[2]

Given this clear shift in capital market conditions, a reasonable question is whether the methodology adopted by FERC in Opinion No. 569-A appropriately accounts for the current market environment. The Beta coefficients discussed above are a significant input to the CAPM. In Opinion No. 569-A, FERC stated, “we find that the use of Value Line betas is appropriate for the CAPM calculation.”[3] While Value Line’s published estimates of Beta generally represent a reasonable estimate, there is a limitation based on Value Line’s quarterly publication schedule that can cause the most recently available Beta coefficient estimates from Value Line’s print-edition to become out-of-date with current market conditions. This limitation becomes apparent in the current capital market environment, where there has been a rapid and significant increase in volatility.

For example, at the time Opinion No. 569-A was released, the most recently available Value Line print-edition reports for companies classified as “Electric Utilities (East)” were published in mid-February 2020, when the average utility Beta coefficient was 0.55. As such, the most recent reports failed to reflect then-current market conditions as the average utility Beta coefficient had increased to 0.85 by May 21, 2020.[4] Not surprisingly, when Value Line updated its Beta coefficients in the mid-June publication of “Electric Utilities (East)” reports, the average Beta coefficient for these companies increased from 0.53 to 0.84.[5] Nonetheless, applying the CAPM methodology described in Opinion No. 569-A at the end-of-May would require relying on the mid-February reports (the most recent publication available for certain companies) containing stale data that no longer reflected current market conditions. Therefore, to analyze the reasonableness of ROEs at the end-of-May, FERC would have to revisit the appropriateness of Value Line Beta coefficients since several estimates failed to reflect current capital market conditions at that point in time.

No single approach or methodology is right at all times, in all capital market conditions. Therefore, it is important that analysts and regulators apply informed judgment when determining the reasonableness of each input to the models, as well as the result of each model in the context of current capital market conditions. While the example discussed above focuses on Beta coefficients, there are several factors that would have to be reevaluated based on recent developments in capital markets relative to the conditions at the time of the analysis applied in Opinion No. 569-A. The extensive intervention of the Federal Reserve to stabilize market conditions has had a significant effect on several other inputs to the DCF, CAPM, and Risk Premium analysis. Much like the Beta coefficients described above, the effect of Federal Reserve intervention on interest rates, dividend yields, and market returns must be analyzed to determine the appropriateness of each input in estimating investors’ expectations of required returns. As established under Hope and Bluefield, the means of arriving at a fair return is not controlling; it is only the end result that leads to just and reasonable rates.[6]

More From Concentric:

Advancing FERC’s Methodology for Determining Allowed ROEs for Electric Transmission Companies

Factors Influencing Utility Cost of Capital in a Period of Market Turmoil

All views expressed by the author are solely the author’s current views and do not reflect the views of Concentric Energy Advisors, Inc., its affiliates, subsidiaries, or related companies. The author’s views are based upon information the author considers reliable. However, neither Concentric Energy Advisors, Inc., nor its affiliates, subsidiaries, and related companies warrant the information’s completeness or accuracy, and it should not be relied upon as such.

[1] Source: Bloomberg Professional. For comparison, the long-term average on the VIX is 19.42.

[2] Source: Bloomberg Professional, adjusted Beta coefficients, five years of weekly returns on the S&P 500 Utilities Index relative to the S&P 500 Index.

[3] 171 FERC ¶ 61,154 (Opinion No. 569-A, May 21, 2020) at para 76.

[4] Beta coefficient estimates were derived from Bloomberg Professional. Value Line Beta coefficients are calculated based on five years of weekly returns against the New York Stock Exchange Composite Index. Bloomberg allows you to select the parameters for calculating Beta. In this analysis, Bloomberg Beta coefficients are calculated on five years of weekly returns against the S&P 500, which is generally consistent with Value Line’s methodology, but allows for more current data to be used.

[5] Source: Value Line, based on the simple average of all companies classified as Electric Utilities (East).

[6] Federal Power Commission v. Hope Natural Gas Co., 320 U.S. 591 (1944) (“Hope”); Bluefield Waterworks & Improvement Co., v. Public Service Commission of West Virginia, 262 U.S. 679 (1923) (“Bluefield”).