Published: March 24, 2021

Contributors: Ruben Moreno, Bob Yardley, Jim Coyne, Dan Dane, Danielle Powers, Forrest Small, John Stewart, and Mark Cattrell

This content is the third installment of a three-part series examining the aftermath of the historic winter weather events in February 2021.

- Part One discussed the urgent financial challenges facing energy regulators in Texas, Colorado, Oklahoma, and Minnesota as customers faced prospect of high electricity and natural gas bills following the winter storm.

- Part Two focused on the role of regulation in addressing the resilience of energy infrastructure and mitigating the consequences of extreme weather events.

In this third installment, we will provide an update on the financial consequences of the February winter storm. These consequences include bankruptcies and lawsuits, and financial impacts for electric utilities, natural gas utilities, and their customers. Investigations by federal and state regulators are under way, with pressure being applied by elected officials including Senators, Governors, and Mayors.

Several more utilities have disclosed extraordinary increases in electricity or natural gas costs, with the impact stretching from Texas and Colorado to several midwestern states including Oklahoma, Kansas, Missouri, Minnesota, and Iowa. Natural gas prices rose to unprecedented levels for five or more days resulting in several utilities reporting gas purchase costs for February that exceeded annual purchases in 2020.

For utilities and states that rely on natural gas as a fuel for electric generation, the bill impacts also extend to electricity customers. Texas’ electricity customers were uniquely impacted by service interruptions and high electricity prices because of well-documented issues within its single-state wholesale electricity market.

Texas also remains the epicenter of political activity. The last of three Commissioners appointed by Governor Abbott has been asked to resign.1 The discussion regarding the repricing of energy, ancillaries, winterization, and unaccounted for energy (“UFE”) in Texas continues.

There is a flurry of legislative activity, including a bill passed by the Texas Senate that supports the repricing of ERCOT market electricity over a 32-hour period, setting a deadline of March 20th for the Public Utility Commission of Texas (“PUCT”).2 The Lieutenant Governor has lent his support for this deadline. However, the House of Representatives is holding firm against repricing for the moment, with the Speaker referring to the bill as, “an extraordinary intervention into the free market.”3

Three energy retailers with operations in Texas and the largest generation and transmission cooperative in the country have declared bankruptcy.

- On March 1st, Brazos Electric Power Cooperative filed a voluntary petition for relief under Chapter 11.4

- On March 9th, Just Energy Group Inc. filed for court protection in Canada and bankruptcy in the U.S.5 and has applied to voluntarily delist its shares from the Toronto Stock Exchange.6

- Griddy Energy LLC has entered bankruptcy proceedings.7

- Entrust Energy, Inc. has defaulted on its obligations to ERCOT8 and PJM.9

As credit requirements and the cost of credit to support retail operations increase, more retail energy providers will likely suffer. Several utilities are looking for ways to finance and securitize debt to cover these charges10 without impacting credit ratings. According to its SEC filing of March 9th, Atmos Energy Corp. completed a public offering of $1.1 billion of its 0.625% senior notes due 2023 and $1.1 billion of its floating rate senior notes due 2023.11 It is expected that the company will use these proceeds to finance about $2.5 billion of natural gas purchased during the February 14th weekend.12

Texas is now entering the litigation phase. San Antonio’s mayor has expressed support for a lawsuit against ERCOT filed by CPS Energy, San Antonio’s large municipal utility. Regardless of the eventual sharing of gains and losses, the financial effects will be permanent for retailers that have gone bankrupt, and long-lasting for utilities that have been forced to take on more debt. As in all the affected states, Texas regulators must sort through the financial impacts as expediently as possible. The first step will be restoring public and market participant confidence in the PUCT and ERCOT.

Utility regulators in several other states have opened dockets to deal with the immediate financial issues and investigate the planning and performance of their electric and gas utilities. Some of these states experienced natural gas prices that exceeded $500/MMBtu and rose as high as $1,000/MMBtu during the mid-February cold snap.

In contrast to Texas, most utilities were able to maintain service to their customers throughout the period. The Southwest Power Pool’s Integrated Market experienced an all-time high day-ahead price of $4,274/MWh on February 15th, as compared to a 2020 average price of $17.81/MWh.13

Based on a review of commission documents, the main topics of interest relate to prudence, cost recovery, rate increases, and communications (Figure 1). The size of the text in the Word Cloud represents the frequency by which the topic is mentioned.

Figure 1: Word Cloud of Topics of Interest to the PUCs in Affected States

Source: Concentric based on PUC discussions in CO, MO, IA, OK, NM, MN, IL, KS, TX, and TN.

Source: Concentric based on PUC discussions in CO, MO, IA, OK, NM, MN, IL, KS, TX, and TN.

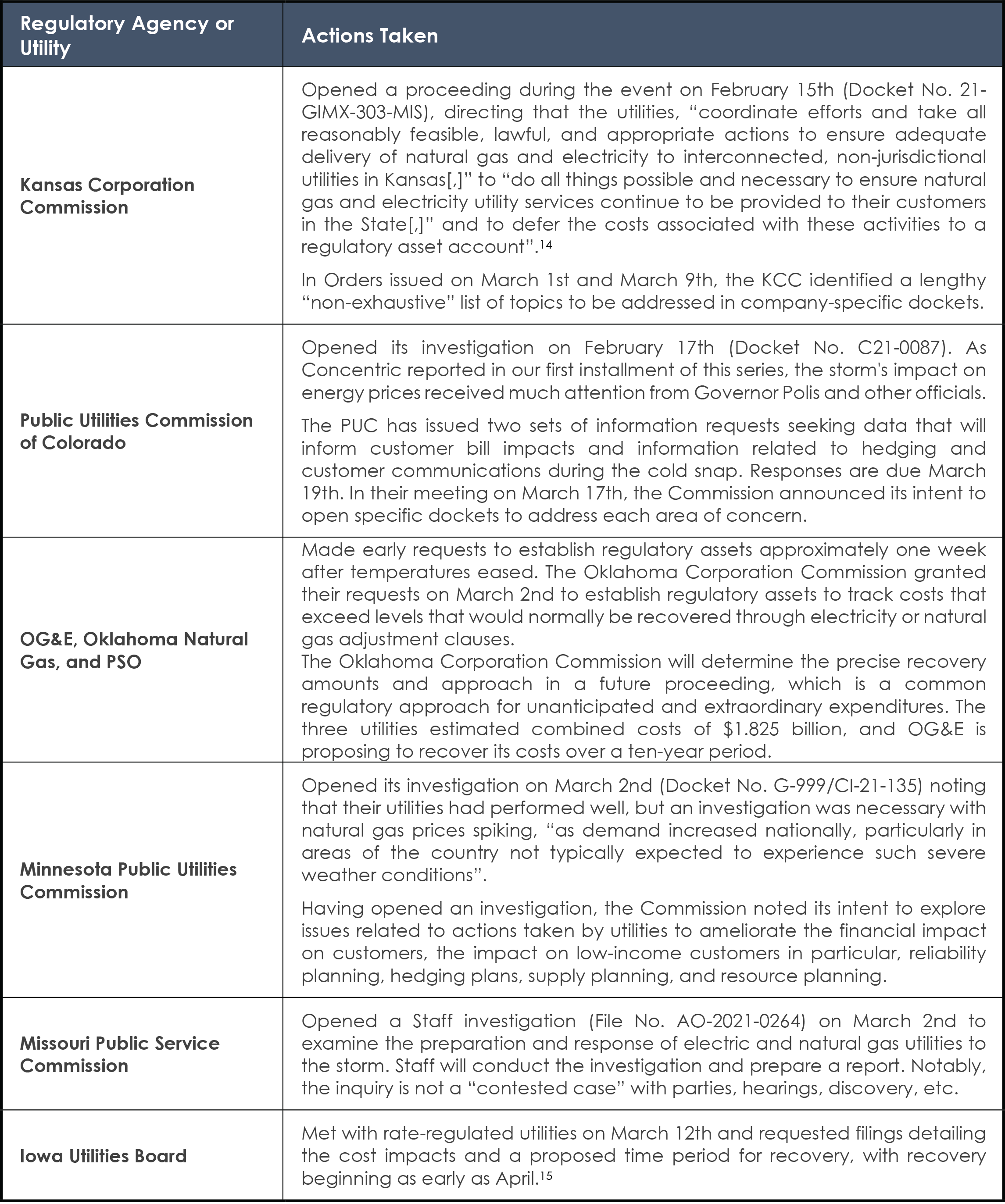

The regulatory approaches vary from state to state, reflecting distinct regulatory practices and philosophies as well as the respective impact of the storm in their jurisdiction. The following brief overview reveals these differences. Kansas and Colorado were early movers.

Meanwhile, the federal inquiries have begun. The Federal Energy Regulatory Commission (“FERC”) and the North American Electric Reliability Corporation (“NERC”) opened a joint inquiry into the operations of the bulk-power system during extreme weather conditions.16

The U.S. Senate held a hearing on March 11th on the reliability, resilience and affordability of the nation’s electric grid and discussed how resource-diverse and complex power grids pose challenges across the country. During this hearing, NERC’s President and CEO indicated that industry and policymakers must consider more investment in transmission and natural gas infrastructure to accommodate the growing share of U.S. generation from intermittent wind and solar energy.17

The authors expect that many lessons learned and associated policy and rule changes will result from the state and federal investigations. It is fair to say, and reasonable to expect, that utilities will face new planning and reporting requirements at a minimum when all is said and done. The Texas/ERCOT situation will be most interesting to see if there will be structural and governance changes related to the retail and wholesale markets, and the integration of natural gas and electricity markets.

More from Concentric:

The Storm Is Over: What Happens Next? – Part 1

The Storm Is Over: What Happens Next? – Part 2

—

All views expressed by the authors are solely the authors’ current views and do not reflect the views of Concentric Energy Advisors, Inc., its affiliates, subsidiaries, or related companies. The authors’ views are based upon information the authors consider reliable at the time of publication. However, neither Concentric Energy Advisors, Inc., nor its affiliates, subsidiaries, and related companies warrant the information’s completeness or accuracy, and it should not be relied upon as such.

1 March 16, 2021 Texas Tribune Article.

2 Senate Bill 2142 passed with a 27-3 vote. https://www.statesman.com/story/news/2021/03/15/bill-filed-texas-senate-could-undo-billions-ercot-overcharges/4701598001/

3 Financial Times, “Power producer NRG’s profit outlook wiped out by Texas storm”, March 17, 2021. The article also reports that market participants have defaulted on $3.1 billion in electricity purchases.

4 Brazos Electric Cooperative serves more than 1.5 million retail customers in Southern Texas. http://www.brazoselectric.com/pressrelease.pdf

5 https://finance.yahoo.com/news/just-energy-seeks-bankruptcy-texas-162232824.html

6 https://finance.yahoo.com/news/1-just-energy-voluntarily-delist-120610775.html

7 https://cases.stretto.com/Griddy

9 https://www.electricchoice.com/blog/pjm-entrust-energy-default/

11 https://www.sec.gov/ix?doc=/Archives/edgar/data/731802/000119312521074937/d56742d8k.htm

13 Staff Report, Appendix A to March 1, 2021 Order in Docket No. 21-GIMX-303-MIS.

14 KCC, Order dated February 15, 2021 in Docket No. 21-GIMX-303-MIS.

15 Iowa Utilities Board press release, March 12, 2021.

16 https://www.ferc.gov/news-events/news/ferc-nerc-open-joint-inquiry-2021-cold-weather-grid-operations

17 https://www.c-span.org/video/?509678-1/senate-energy-committee-hearing-electric-grid-reliability