Published: February 6, 2024

Overview:

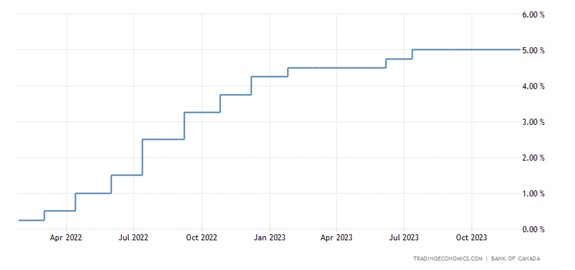

Authorized returns on equity (ROE) have increased for many Canadian electric and gas utilities, as regulators recognize that the cost of capital has risen for all companies, including regulated utilities. The most prevalent signs of shifting financial fundamentals are found in bond markets. Over the past two years, the Bank of Canada ratcheted short-term interest rates to 5.0% (the highest level in 22 years) to combat inflation well above the targeted 1-3% range.

Figure 1: Bank of Canada Overnight Rate

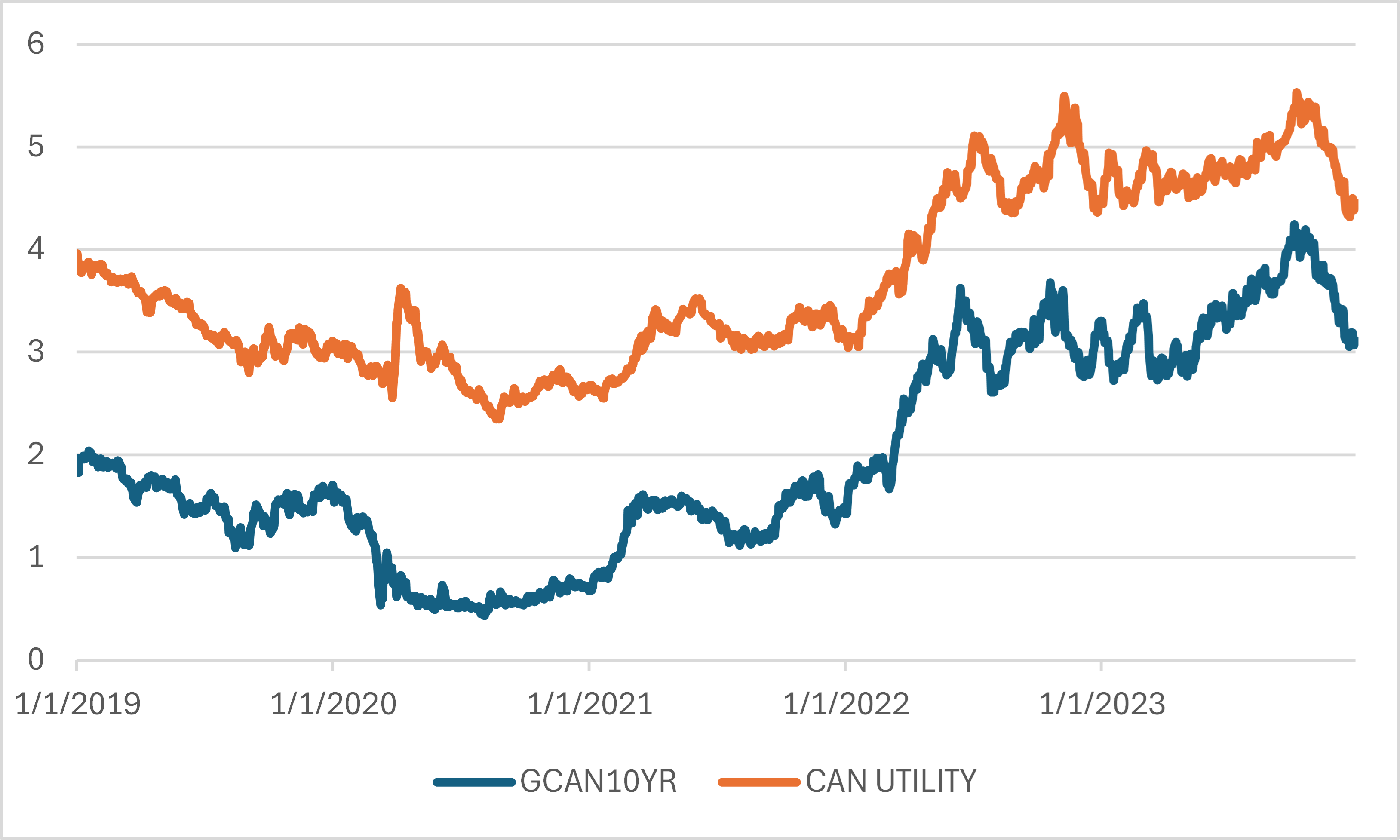

In response, Canadian government and utility bond yields increased by 150 to 200 basis points since 2022 as restrictive monetary policy contributed to tighter conditions in credit markets. While moderating in recent months, 10-year Canadian government bond yields remain between 3.25% and 3.50%, heralding an end to the ultra-low interest rate environment that followed the financial crisis of 2008–2009.

Figure 2: 10-year Canadian Government Bond Yield and Utility Bond Yield1

Deemed equity ratios have also increased for several Canadian gas and electric utilities as regulators acknowledge that public policy mandates related to the energy transition equate to higher business risk for these companies. Despite recent increases to equity ratios for several Canadian utilities, the deemed equity thickness in Canada remains well below the U.S. average, as shown in Tables 1 and 2 below. The following section summarizes recent cost of capital decisions across Canada.

Summary of Recent Decisions:

Alberta – The Alberta Utilities Commission (AUC) concluded a generic cost of capital (GCOC) proceeding in which the AUC implemented an ROE formula tied to changes in government bond yields and utility credit spreads. The base ROE was set at 9.0%, and the formula return for 2024 will be 9.28%. This is the highest authorized ROE in Alberta in over a decade and represents a substantial increase over the previous return of 8.50%. The AUC also heard arguments regarding the deemed equity ratio but did not make any changes in that regard. (Decision 27084-D02-2023, released October 9, 2023)

British Columbia – The British Columbia Utilities Commission (BCUC) also concluded a GCOC proceeding for FortisBC Energy Inc. (a gas distribution utility—FEI) and FortisBC Inc. (an electric utility—FBC). The BCUC increased the authorized ROE for both companies to 9.65% based on the average results for a North American proxy group, as compared to the previous return of 8.75% for FEI and 9.15% for FBC. The BCUC also recognized that the energy transition had caused an increase in FEI’s business risk, and the deemed equity ratio was increased from 38.5% to 45.0% to account for the higher risk. FBC’s deemed equity ratio was also increased from 40.0% to 41.0%. The BCUC has initiated Stage 2 of the GCOC proceeding to review the authorized cost of capital for smaller utilities, including Pacific Northern Gas, and to determine which utility, if any, will serve as the benchmark in British Columbia. (Decision G-236-23, issued September 5, 2023)

New Brunswick – The New Brunswick Energy and Utilities Board, in a Rehearing Decision based on an appeal by Liberty Utilities (formerly Enbridge Gas New Brunswick), approved an ROE of 9.8% on a 45% common equity ratio. The ROE was down from the 10.9% last set for the Company in 2010, while the equity ratio remained unchanged. (Rehearing Decision Matter No. 491, issued November 18, 2022)

Nova Scotia – The Utilities and Review Board (UARB) maintained the authorized ROE for Nova Scotia Power (NS Power) at 9.0% in the first general rate case for the Company since 2012. The UARB recognized that energy transition issues in Nova Scotia (specifically the requirement to retire coal generation facilities and replace the power with renewable resources) increased the business risk for NS Power. Consequently, the deemed equity ratio for NS Power was increased from 37.5% to 40.0%. NS Power’s request for a storm cost deferral account to recover extraordinary storm costs above the level in base rates was also approved. (Decision 2023 NSUARB 12, M10431, issued February 2, 2023)

The UARB also approved a settlement agreement for Eastward Energy (formerly Heritage Gas), which included an authorized ROE of 10.65%, a decrease from the 10.8% last approved for the Company in 2011, and a deemed equity ratio of 45.0%, unchanged from its prior level. (Decision 2023 NSUARB 166, M10960, issued September 20, 2023)

Ontario – The Ontario Energy Board (OEB) recently issued a decision on Enbridge Gas’ request for a higher common equity ratio. The OEB found that Enbridge Gas’ business risk had increased due to the energy transition, although the OEB determined that it was partially offset by the amalgamation of Enbridge Gas Distribution and Union Gas. Consequently, the OEB increased the deemed equity ratio for Enbridge Gas from 36.0% to 38.0%. The OEB sets the authorized ROE for electric and gas utilities under a formula mechanism that adjusts the return each year based on changes in government bond yields and utility credit spreads. The formula return in 2024 will be 9.21%, down from 9.36% in 2023. The OEB has also indicated that it plans to review the formula and the deemed equity ratios for Ontario’s regulated electric and gas utilities in 2024. (Decision and Order EB-2022-0200, issued December 21, 2023; OEB letter, Chief Commissioner Mid-Year Update 2023–24, October 19, 2023)

Prince Edward Island – The Island Regulatory and Appeals Commission (IRAC) approved a settlement agreement for Maritime Electric Company that maintains the authorized ROE of 9.35% on 40.0% common equity. The settlement also included a provision that removed the hard cap on Maritime Electric’s earnings, such that the Company is now allowed to retain up to 35 basis points of actual earnings above the authorized level. (Order UE23-04, released April 24, 2023)

Pending Cases:

Newfoundland and Labrador – Newfoundland Power filed a general rate application in November 2023 that included a request to increase the authorized ROE from 8.50% to 9.85% while maintaining the deemed equity ratio of 45.0%. The application is currently pending, and a decision is expected later in 2024.

British Columbia – A Stage 2 proceeding is underway in British Columbia, where the BCUC will set the authorized ROE and equity ratio for smaller utilities, including Pacific Northern Gas, as well as determine what company will serve as the benchmark utility.

Table 1: Canadian Electric Utilities

| Operating Utility | Deemed Equity Ratio | Authorized ROE | Recent Changes |

| Alberta Electric Utilities | 37.0% | 9.28% | ROE increased from 8.50%; new base ROE is 9.00%; new formula implemented |

| FortisBC Electric | 41.0% | 9.65% | ROE increased from 9.10%; equity ratio increased from 40% |

| Ontario Electric Utilities | 40.0% | 9.21% | ROE decreased from 9.36% under formula |

| Maritime Electric | 40.0% | 9.35% | Raised cap on earnings to 9.70% |

| Newfoundland Power | 45.0% | 8.50% | Pending |

| Nova Scotia Power | 40.0% | 9.00% | Equity ratio increased from 37.5% due to energy transition risk |

| Canadian Electric Avg | 40.5% | 9.17% | |

| U.S. Electric Utility Avg2 | 51.6% | 9.66% |

Table 2: Canadian Gas Distribution Utilities

| Operating Utility | Deemed Equity Ratio | Authorized ROE | Recent Changes |

| ATCO Gas Distribution | 37.0% | 9.28% | ROE increased from 8.50%; new base ROE is 9.00%; new formula implemented |

| Apex Utilities | 39.0% | 9.28% | ROE increased from 8.50%; new base ROE is 9.00%; new formula implemented |

| Eastward Energy | 45.0% | 10.65% | ROE decreased from 11.0% |

| Enbridge Gas | 38.0% | 9.21% | Equity ratio increased from 36.0% due to energy transition risk |

| FortisBC Energy Inc. | 45.0% | 9.65% | ROE increased from 8.75%; equity ratio increased from 38.5% due to energy transition risk |

| Gaz Métro LP | 38.5% | 8.90% | |

| Gazifère | 40.0% | 9.05% | |

| Liberty Gas New Brunswick | 45.0% | 9.80% | |

| Pacific Northern Gas – West | 46.5% | 9.50% | Stage 2 Pending |

| Canadian Gas Avg | 41.6% | 9.48% | |

| U.S. Gas Utility Avg3 | 52.3% | 9.57% |

For more information, please contact John Trogonoski, Jim Coyne, or Dan Dane.

1Source: Bloomberg Professional; data through December 29, 2023.

2 S&P Global Market Intelligence, based on electric rate case decisions from January 1, 2023 through December 19, 2023.

3 Ibid.

—

All views expressed by the author are solely the author’s current views and do not reflect the views of Concentric Energy Advisors, Inc., its affiliates, subsidiaries, related companies, or clients. The author’s views are based upon information the author considers reliable at the time of publication. However, neither Concentric Energy Advisors, Inc., nor its affiliates, subsidiaries, and related companies warrant the information’s completeness or accuracy, and it should not be relied upon as such.