Published on April 14, 2020

By: John Trogonoski, Assistant Vice President

After trading at record highs in February 2020, stock markets around the globe have entered a period of extreme uncertainty and volatility as investors try to understand the potential economic and financial consequences of two external shocks: 1) a global pandemic (i.e., COVID-19); and 2) the resulting impacts on the worldwide economy. As a result, we have witnessed a sudden and sharp loss in stock market valuations and investor “flight-to-quality.”

While investors typically perceive utilities as a safe haven during periods of uncertainty, there has been a high degree of correlation between utility stocks and the broader market in the current market dislocation. The table below shows the decline in equity prices for the broad market in the U.S. and Canada, and individual sectors within the utility industry.

| Peak to Trough % Decline | Mean % Decline as of 4/9/2020 | |

| S&P 500 Index | -35.63% | -17.95% |

| S&P Utilities Index | -38.90% | -14.44% |

| Electric | -29.37% | -18.47% |

| Natural Gas Distribution | -25.41% | -18.29% |

| Water Distribution | -16.32% | -11.44% |

| TSX Index | -37.42% | -21.05% |

| Canadian IOUs | -31.96% | -19.90% |

Even as government bond yields in the U.S. and Canada have fallen to near-record low levels, and central banks have reduced short-term interest rates and provided other monetary stimuli to support the global economy, the following factors suggest that risk has increased for equity investors:

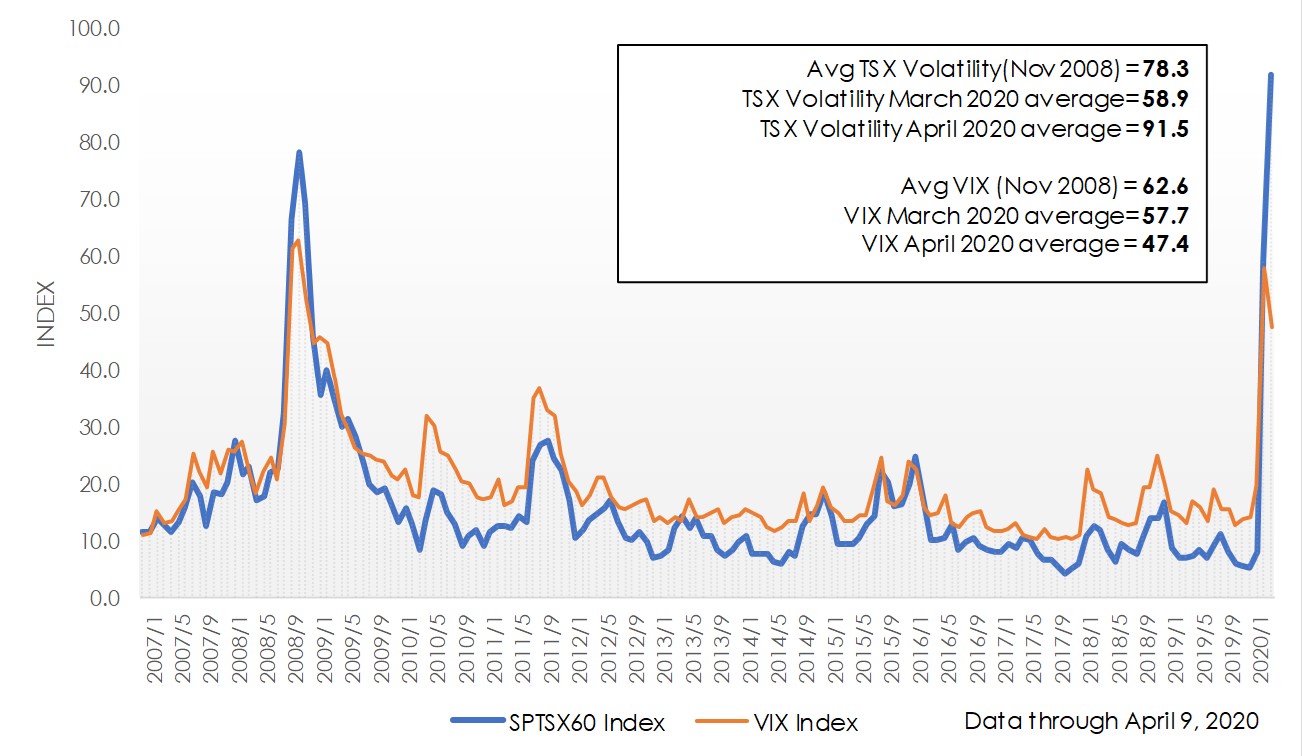

- Extreme volatility in equity markets: In the U.S., the Chicago Board Options Exchange Volatility Index (VIX) rose above 80 in mid-March 2020 for the first time since October 2008 during the height of the global financial crisis. The VIX has recently declined to slightly above 40 but remains well above the average level since 2007 of about 19.6. Canadian equity markets have experienced a similar spike in volatility during this period, with the Toronto Stock Exchange (TSX) volatility index rising above 90 every day so far in April 2020, exceeding its peak during the 2008 financial crisis.

- Credit spreads have also increased: Spreads between 30-year Treasury bonds and Moody’s A and Baa rated utility bonds have risen substantially. In the secondary market, the average spread between 30-year U.S. Treasury bonds and Moody’s Baa-rated utility bonds has been 246 basis points since February 24, 2020, compared to the prevailing average of 145 basis points from July 1, 2019, through February 21, 2020. In Canada, the average spread between 30-yr Government of Canada bonds has been 191 basis points since February 24, 2020, compared to the average of 139 basis points from July 1, 2019, through February 21, 2020. In the primary market, credit spreads between U.S. Treasury bonds and new utility debt issuances have ranged from 240 to 300 basis points since mid-March 2020, as compared to 70 to 120 basis points in the second half of 2019.

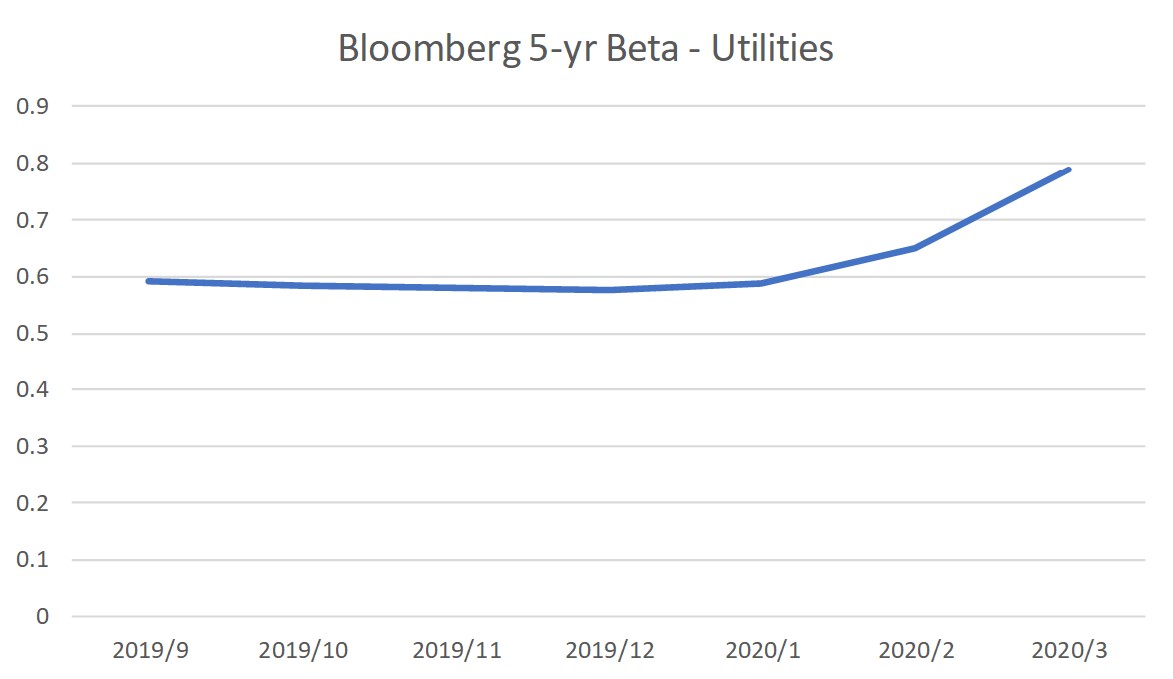

- Utility betas have increased substantially: Beta is a measure of risk. In recent weeks, the correlation between utility stock prices and the broader market has risen to near 0.9. The chart below shows that average betas calculated over 5 years for U.S. and Canadian utilities were consistently around 0.60 from September 2019 through January 2020. In February and March, 5-year betas have trended up to about 0.79, as utilities traded more inline with the S&P 500 Index. The increase in 2-year betas has been even more pronounced over this period. This suggests that investors do not perceive utilities as a safe haven during the current flight to quality.

These indicators suggest that investment risk has increased in the market for equities broadly, and also for utilities. Equity and credit analysts have also expressed concern about other important issues such as rising uncollectible accounts, industrial load concentration, a potential moratorium on rate increases, and challenges to decoupling mechanisms. The ultimate impact of this period of elevated risk for utilities depends in large part to both investor reactions and the regulatory policy response to the economic downturn. Maintaining healthy access to capital markets on favorable terms remains a broadly accepted standard of utility regulation, benefiting both customers and shareholders. As was the case in the Great Recession of 2007-09, capital markets will once again be tested for the pricing of risk, and utilities are not escaping this scrutiny.

All views expressed by the authors are solely their current views and do not reflect the views of Concentric Energy Advisors, Inc., its affiliates, subsidiaries, or related companies. The authors’ views are based upon information they consider reliable. However, neither Concentric Energy Advisors, Inc., nor its affiliates, subsidiaries, and related companies warrant the information’s completeness or accuracy, and it should not be relied upon as such.