Published: May 24, 2022

By: John Trogonoski, Assistant Vice President

Key Points:

- As U.S. consumers experience increasing prices unlike anything the nation has seen since the 1980s, regulated utilities are acting to manage their financial integrity and meet their customers’ needs. Without an appropriate and timely regulatory response, periods of high inflation can erode the ability of the utility to earn its authorized return and may pressure credit metrics and credit ratings.

- Utilities’ costs will be affected by higher inflation in many ways. This includes O&M costs, A&G costs, capital investments, and the cost of debt and equity capital. At the same time, there will be mounting pressure on regulators to minimize customer rate increases. As always, maintaining an appropriate balance between the needs of the utility and its customers is essential.

- Authorized returns should consider the likelihood of rising interest rates during the period in which rates will be in effect. Formula rates are one way to accomplish this objective.

- Additionally, multi-year rate plans offer the flexibility to increase the authorized Return on Equity (ROE) in later years if bond yields are higher than when the plan was approved.

- Utilities under a performance-based rate plan linked to inflation need to anticipate efforts by regulators and stakeholders to revise the (I-X) formula (where I is inflation and X is productivity) used to determine annual rate increases. Those plans with percentage caps on the allowed annual rate increases may place undue pressure on the utility’s cash flows and earnings under current conditions.

- In light of inflation concerns, regulators must adapt to market conditions that the U.S. has not experienced in almost 40 years.

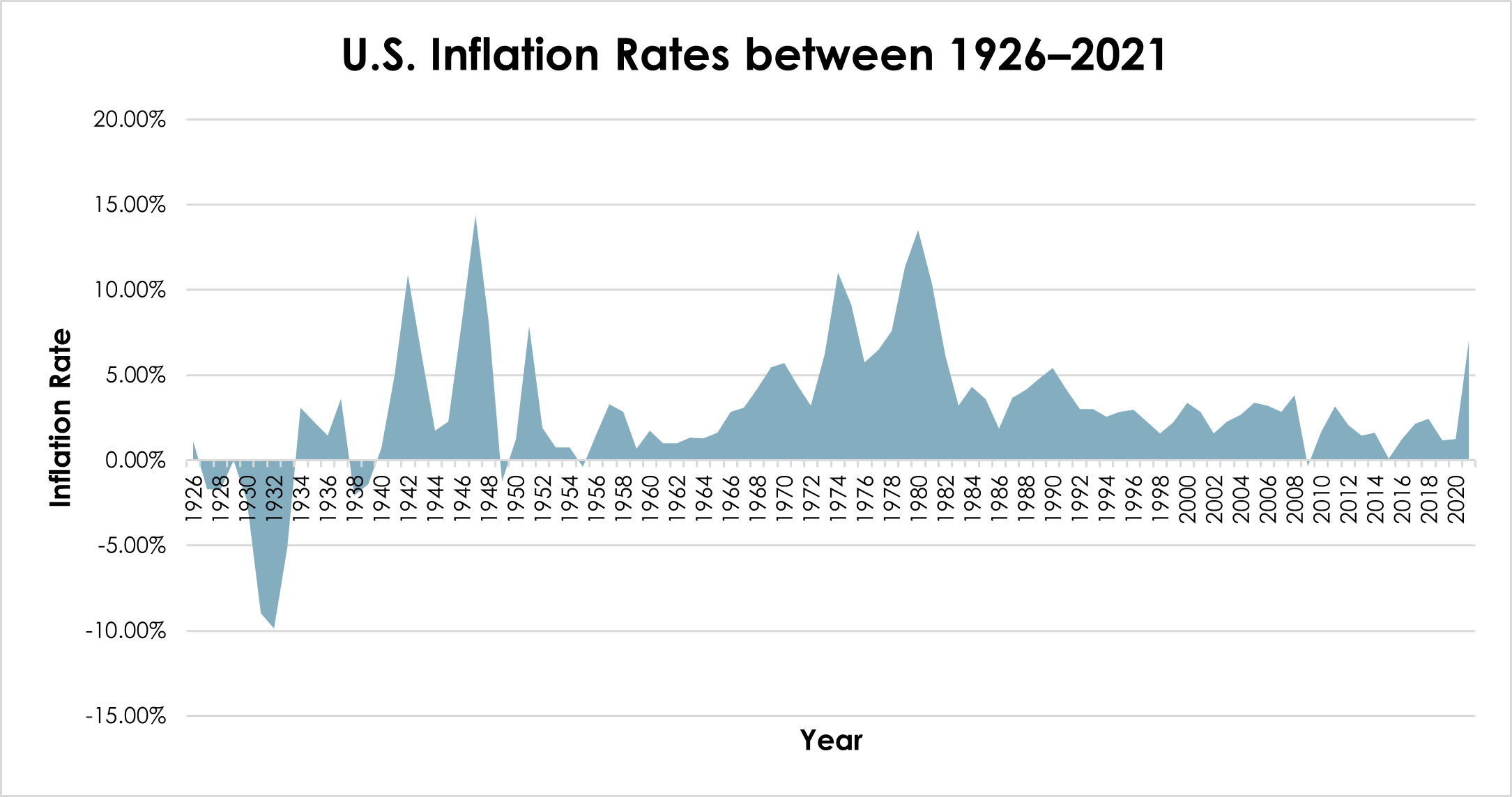

Consumer prices for the 12 month period ending in April 2022 increased at an annualized rate of 8.3%, according to the U.S. Bureau of Labor Statistics. By comparison, the average annual inflation rate from 1926–2021 was 3.04%, and the median inflation rate was 2.75%.

Since 1926, the U.S. has only seen 12 years that had inflation rates of 7.0% or higher, including 2021.

Periods of high inflation have typically lasted 2–4 years and usually coincide with some external shock. Prior periods of high inflation include:

- 1946–1948: Post-WWII, and a total increase of 33.9%

- 1974–1975: The Arab oil embargo. Inflation started rising in 1973, with a total increase of 28.7%.

- 1978–1981: A total increase of 50.0%: While external shocks such as the second Arab oil embargo of 1979 have been blamed, economists also cite the failure of monetary policy and excessive growth in money supply combined with deficit government spending.

Examined over 1965 to 1982, economists characterize this period as the “Great Inflation”, caused by both external shocks and a failure of macroeconomic and monetary policies.1

Other years with inflation greater than 7.0% include 1942, 1951, and 2021.

Although inflation was initially characterized in 2021 as “transitory” by the Federal Reserve Board (Fed), the Fed now recognizes the inflationary pressure and expectations are more persistent. As a result, the Fed has recently started raising short-term interest rates from historically low levels, and the federal funds rate is currently within a range from 0.75% to 1.00%. As a point of comparison, the federal funds rate in 1981 averaged 16.39% to combat persistently high inflation that started in 1973 and continued through 1982.

Equity markets are also affected by higher inflation because stock valuations depend, to some degree, on the level of interest rates and on investor expectations for inflation. Higher inflation has not always led to lower stock prices. In fact, the only years in which stocks were lower during periods of high inflation were 1946, 1973–1974, and 1981. But, the U.S. stock market in 2022 is off to its worst start in 60 years as investors adjust stock valuations to reflect higher interest rates, tighter monetary policy and supply chain disruptions from the Covid 19 pandemic and the War in Ukraine.

Average authorized returns for electric and gas utilities have been below 10% in recent years. By comparison, the average authorized ROEs for electric and gas utilities from 1980–1982 were 15.12% and 15.03%, respectively. As inflation approaches levels seen in the early 1980s, pressures will mount to increase allowed equity returns to attract capital for both ongoing investment needs and the accelerated transition to lower carbon networks. While utility customers have the protection of regulation not afforded to other energy consumers, customers will ultimately bear the costs of higher inflation in their rates.

—

All views expressed by the contributors are solely the contributors’ current views and do not reflect the views of Concentric Energy Advisors, Inc., its affiliates, subsidiaries, or related companies. The contributors’ views are based upon information the contributors consider reliable at the time of publication. However, neither Concentric Energy Advisors, Inc., nor its affiliates, subsidiaries, and related companies warrant the information’s completeness or accuracy, and it should not be relied upon as such.

1 https://www.federalreservehistory.org/essays/great-inflation