Published on: March 5, 2021

Contributors: Ruben Moreno, Jim Coyne, Bob Yardley, Dan Dane, Danielle Powers, Forrest Small, John Stewart, and Mark Cattrell

Customers in several states, including Texas, Colorado, Oklahoma, and Minnesota, are facing the prospect of unprecedented levels of electricity and natural gas bills.

Utilities that rely on wholesale markets to purchase electricity and natural gas are required to pay for supplies each week (electricity) or each month (natural gas). These bills are coming due, creating a financial emergency for many utilities. State regulators have two equally challenging and important responsibilities:

- Determining how to respond to customers’ immediate financial crises and the utilities that serve them.

- Reflecting on lessons learned and considering changes to applicable rules and policies.

This article deals with the immediate challenges facing customers, utilities, and state regulators.3

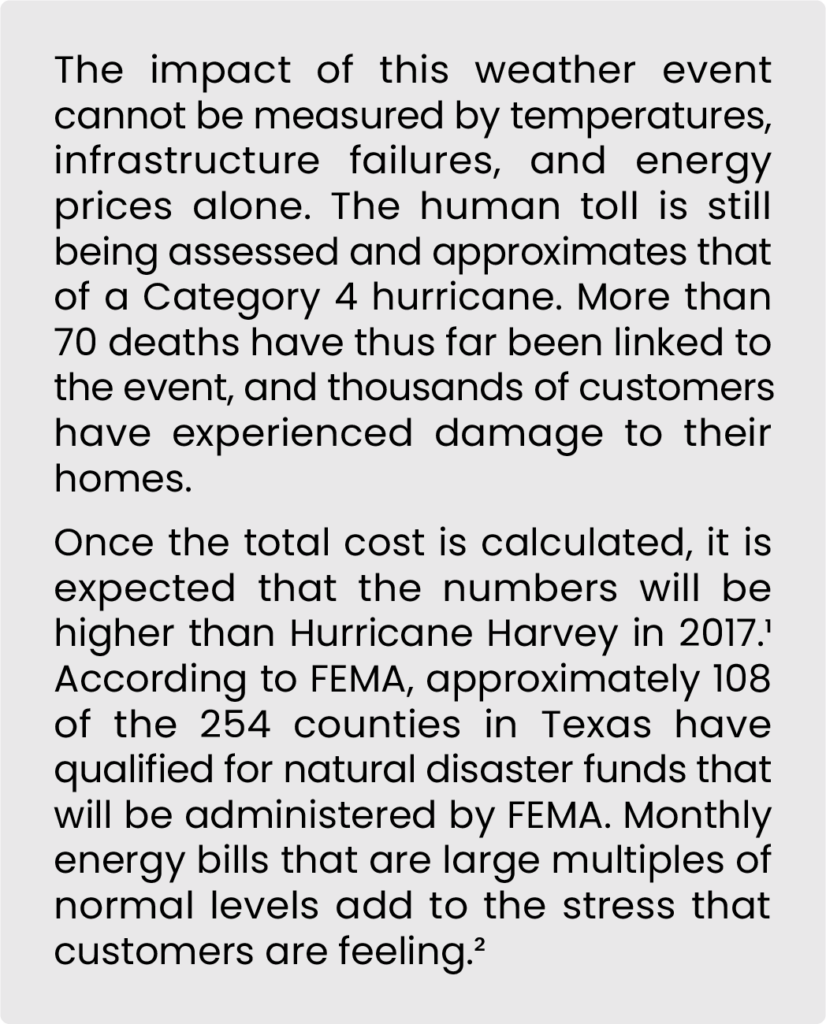

What Happened: At a Glance

Focusing on Texas first, a severe winter storm hit over the weekend of February 14th delivering the lowest temperatures in more than 30 years accompanied by record snow accumulations. While the assessment is ongoing, demand for electricity exceeded historical levels which, combined with electricity infrastructure failures, resulted in electricity generation operating margin levels that were lower than ERCOT’s planning assumptions.

ERCOT reported generation capacity outages that peaked at 52% for natural gas, 57% for wind, 44% for coal, 12% for solar, and 13% for nuclear. As a result, ERCOT entered the weekend with a generation shortfall of approximately 45% and was forced to implement rolling blackouts on February 15th to keep the system from experiencing cascading failures.4

Wholesale costs of electricity in ERCOT spiked to a total of $50.6 billion for just a 3-day period. To put this in context, total wholesale costs of electricity were $4.2 billion for the seven days ending February 9, 2021.5 Electricity prices cleared at the maximum energy offer price of $9,000/MWh, and ancillary prices exceeded $20,000/MWh.6 Electric bills from ERCOT have already been issued, and ERCOT reports a shortage of $2.1 billion in payments after the freeze, approximately a 17% delinquency.7

The full account of the financial impact is not yet known, but utilities and retail suppliers have begun disclosing losses with at least one utility estimating a payment obligation to its wholesale market operator approaching $3.5 billion.8 Coming up with the liquidity to pay these invoices will be very challenging, and credit-rating agencies are already putting many utilities on a negative credit outlook before the final accounting is in.9

Retail electric suppliers in ERCOT are also facing an uncertain future as they look for ways to shore up their finances. On Friday, February 26th, ERCOT effectively shut down Griddy Energy LLC (an energy retailer) when it suspended Griddy’s access to the state’s power network due to unpaid bills.10 Brazos Electric Power Cooperative, Inc., which describes itself as the largest generation and transmission cooperative in Texas,11 filed for bankruptcy facing more than $2.1 billion in sudden bills stemming from the extreme winter weather.12 Based on ERCOT’s rules, retail power providers who do not pay within 72 hours can have all their customers reassigned to other providers.

Natural gas markets experienced similar disruption as residential heating demands increased while gas was also being relied on to fuel the gas-fired generation that remained on-line. Natural gas experienced its own contingencies that exceeded design conditions as production was adversely impacted by extreme temperatures in Texas and across the Southwest and the Midwest.

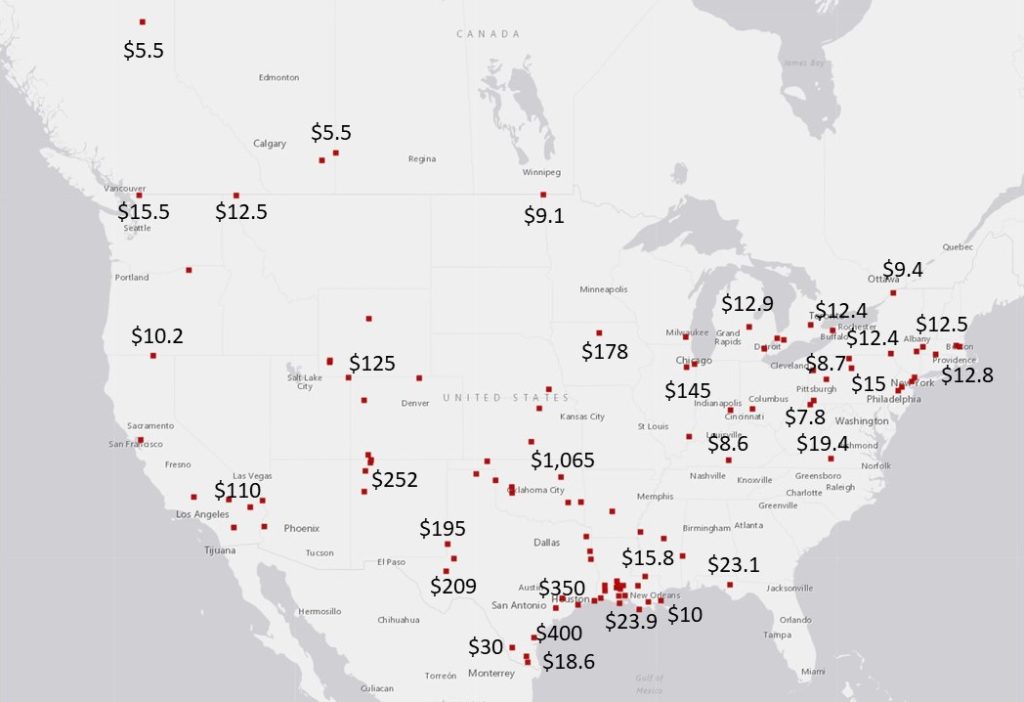

Natural gas prices increased from $2.30/MMBtu during the first two weeks of February to as high as $1,065.50/MMBtu for delivery in Tulsa, OK (ONG at Tulsa) on February 18th, 2021. Gas price impacts reverberated throughout the country, affecting locations from California through Chicago, while gas from the Marcellus area acted as a buffer for prices in the Northeast (Figure 1).

Figure 1: Maximum Observed Prices Natural Gas Spot from Feb 11 – Feb 23, 2021 ($/MMBtu)

Public Officials Respond to a Call for Action

Governors in multiple states have called for regulators to begin investigations. Jared Polis, Governor of Colorado, is encouraging the Colorado Public Utility Commission to define clear and specific actions utilities must take to protect Coloradans from excess costs resulting from fluctuating commodity prices. Governor Polis indicated that utilities may have failed to alert customers to take action to conserve energy during the cold snap.13

Greg Abbott, Governor of Texas, has vowed to overhaul ERCOT, mandate weatherization of infrastructure, and provide economic relief to customers.14 We expect that many regulatory agencies will need to address the financial impacts of this event and that regulators in most states will examine the likelihood and potential impacts of extreme weather events in their states.

The Immediate Challenge

Utilities are in the position to compile the financial information that regulators will need to assess the immediate implications for both customers and utilities. This is an urgent demand as the public clamors for information about the potential impact on customer bills. It is also an urgent need for credit agencies that assess the financial strength of the nation’s utilities.

Regulators have a strong interest in customer impacts and utility financial conditions, and emergency actions to address customer impacts and utility financial conditions are likely. These could include deferrals, short-term borrowings, and a transition to a longer-term cost recovery approach, including securitization. At the same time, it will be critical for regulators to communicate how they will address prudence questions to avoid creating additional financial uncertainty that harms both customers and utilities.

There will be prudence investigations to determine what happened and how the adverse impacts can be mitigated in the future. Investigations that consider whether the utilities acted properly will take time and need to avoid the use of hindsight to judge the actions of the parties involved. However, urgent actions, including decisions on the deferral of cost recovery and the authorization of borrowings to maintain financial integrity should not be held up by a desire to look backward or identify future policy actions.

It is the authors’ view that any issues of prudence should be separated from the immediate financial issues that must be resolved to keep markets operating, maintain energy service to customers, and maintain credit quality for utilities. The subsequent investigations are equally important as regulators, utilities, customers, and other stakeholders will want to understand and assess actions by the utility related to short- and long-term planning, procurement, hedging, risk-sharing, operation, preparation for the emergency, and communication during the event.

More from Concentric:

The Storm Is Over: What Happens Next? – Part 2

The Storm Is Over: What Happens Next? – Part 3

—

All views expressed by the authors are solely the authors’ current views and do not reflect the views of Concentric Energy Advisors, Inc., its affiliates, subsidiaries, or related companies. The authors’ views are based upon information the authors consider reliable at the time. However, neither Concentric Energy Advisors, Inc., nor its affiliates, subsidiaries, and related companies warrant the information’s completeness or accuracy, and it should not be relied upon as such.

Disclaimer Notice: Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice. Credit ratings are statements of opinions and are not statements of fact.

1 https://www.nytimes.com/2017/08/28/climate/how-hurricane-harvey-became-so-destructive.html

2 https://gov.texas.gov/news/post/governor-abbott-announces-fema-approval-of-additional-18-texas-counties-for-major-disaster-declaration#:~:text=The%2018%20counties%20include%20Atascosa,Trinity%2C%20Webb%2C%20and%20Willacy.

3 The Federal Energy Regulatory Commission will focus on questions related to whether any actors engaged in market manipulation or price gauging in wholesale markets that are subject to their jurisdiction, a role they performed in the aftermath of the 2000-01 California energy crisis.

4 Testimony of Bill Magness, then-President and CEO of Electric Reliability Council of Texas, Inc. State Senate Committee on Business and Commerce hearing. February 25th, 2021.

5 Texas Senator Nathan Johnson. State Senate Committee on Business and Commerce hearing. February 25th, 2021.

6 https://www.bloomberg.com/news/articles/2021-03-01/texas-market-monitor-recommends-price-cap-for-ancillary-services

7 https://www.wsj.com/articles/texas-power-market-is-short-2-1-billion-in-payments-after-freeze-11614386958

8 https://www.dallasnews.com/business/energy/2021/02/22/deep-freeze-brings-winners-and-losers-among-energy-suppliers/

9 https://www.fitchratings.com/research/us-public-finance/fitch-places-texas-public-power-utilities-electric-cooperatives-on-rating-watch-negative-24-02-2021

10 https://news.yahoo.com/texas-electric-firm-griddy-loses-002356449.html

11 http://brazoselectric.com

12 Texas Blackout Bills Plunge Power Supplier Brazos Into Bankruptcy – WSJ

13 Jared Polis, Governor of Colorado. February 23, 2021. Letter to the Public Utility Commissioner.

14 https://gov.texas.gov/news/post/governor-abbott-delivers-televised-statewide-address-on-power-outages-winter-weather-response-in-texas